You work. Let EITC work for you!

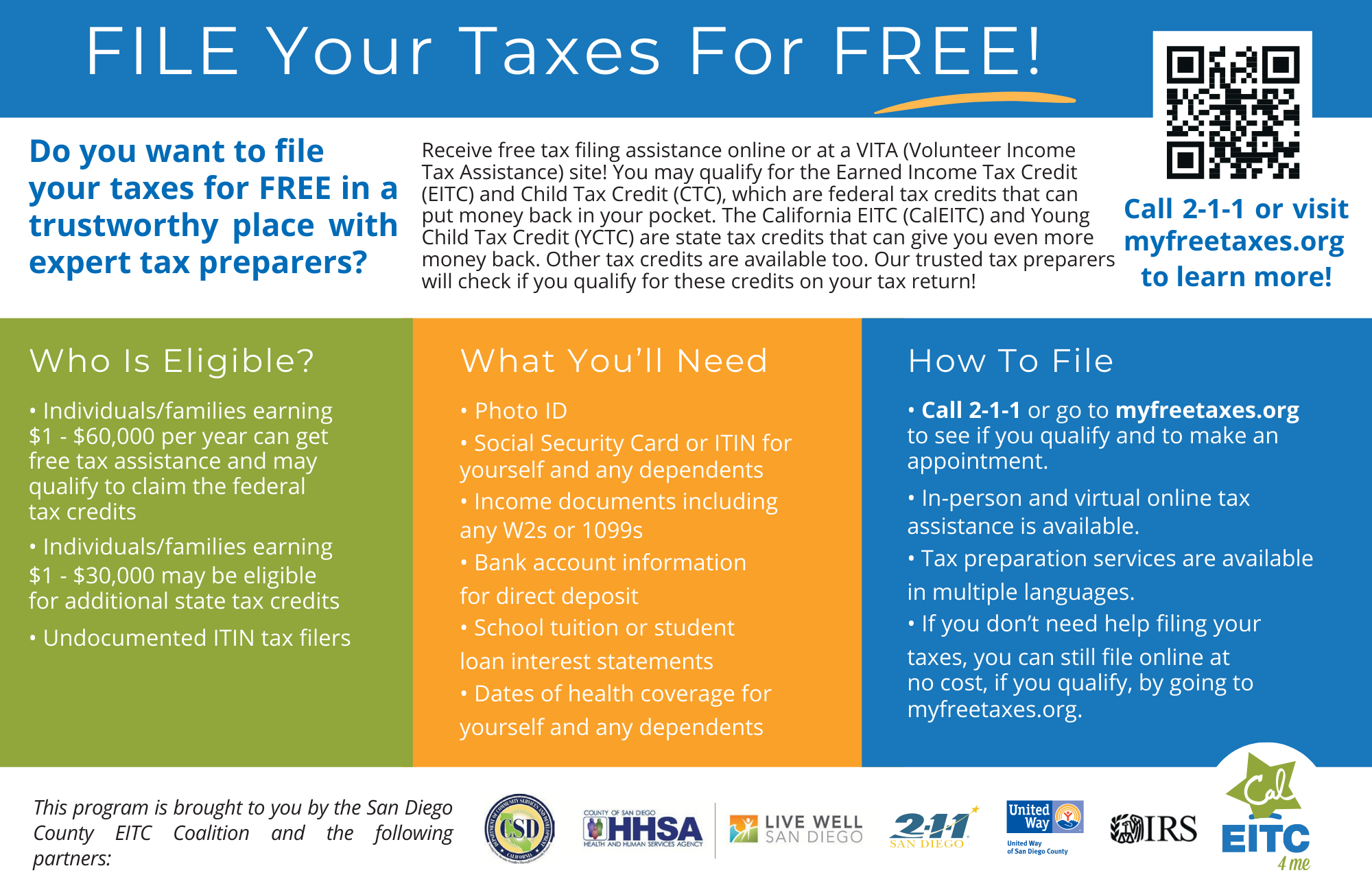

Lifeline's is an IRS approve volunteer site with Volunteer Income Tax Assistants ready to help individuals and families file their taxes for free this tax season. Don't miss out on returns you could be getting this year. Did you know that for more than 40 years, the Earned Income Tax Credit made life better for millions of workers? You may have extra money waiting for you. If you qualify and claim the credit, it could be as much as $7,430 from the IRS for some workers.

Don’t be the one in five that misses this credit. If you or someone you know earned less than $63,698 from wages, running a business or farm or from Form 1099 MISC, check it out.

It’s easy to find out if you qualify. Use the EITC Assistant, available late January, and answer questions about yourself and other family members to see if you qualify and estimate the amount of your credit.

EITC eligibility depends on several factors, including income and family size. If you don’t have a qualifying child and earned under $17,640 ($24,210 married filing jointly), find out if you qualify for a smaller credit, worth as much as $600. Don't guess about EITC eligibility use the EITC Assistant to find out if you do qualify for EITC, And, see what other tax credits are available.

It’s easy to find free tax help to prepare and file your taxes, let Lifeline help or use the VITA locator tool on IRS.GOV to find a volunteer site near you. Or, you can prepare and e-file your own taxes with brand-name software using IRS’s Free File.

Visit https://irs.treasury.gov/freetaxprep/jsp/direction.jsp?id=26560&lng=-117.241823&lat=33.203452 for more information.

Service Details:

Tue 3:00PM to 7:00PM Appointment recommended. Schedule by calling 211 San Diego or visit go.oncehub.com/Lifeline. Walk-ins are first come, first served with no guarantee of service. Appointments have priority. Fri 12:00PM to 6:00PM ;Sat 10:00AM to 3:00PM

Appointments will open on January 30th, 2024: ApptURL: go.oncehub.com/Lifeline